Category: Events

(Training) Rideshare Taxes: What Your Tax Volunteers Should Know

Tax preparation for rideshare drivers can be difficult to navigate. Taxpayers often do not know that they are self-employed and are not aware of the impact driving full time or as a “side hustle” can have on their tax returns. Additionally, figuring out what is their total income and allowable deductions can lead to incorrect reporting.

VITA programs can help these taxpayers overcome this confusing process. This training provides information, resources, and tools on how to best help this growing population.

This training features Francesca Jean-Baptiste, Director of Tax Partnerships at the CASH Campaign of Maryland.

Download the presentation slides and notes.

Get Taxathon-Ready Q&A Session

Are you ready to host a Taxathon in 2019, or thinking about it? Do you have questions about logistics or where to begin planning?

Join the Get It Back Campaign for a Taxathon Planning Q&A Session to get answers from experienced Taxathoners!

During this session, you can get feedback about your ideas, receive advice on next steps to take, get support developing a timeline to keep you on track, and ask ANY questions you have about organizing a Taxathon. You will also be able to connect with others who will be hosting Taxathons in 2019.

If you are undecided about hosting a Taxathon, join the call to talk through the pros and cons for your organization.

Panelists:

• Andrea Kiepe, Prepare + Prosper – St. Paul, MN

• Courtney O’Reilly, The Piton Foundation – Denver, CO

• Brittany Sims, Louisville Asset Building Coalition – Louisville, KY

Be ready to take notes!

You may find it helpful to refer to the Taxathon resources during the call, or to review them in advance.

Recording: Effective Ways to Promote Split Refunds

Saving money shouldn’t be complicated. Tax time provides a unique opportunity to encourage clients to save more money by splitting their refund.

Learn about the national Save Your Refund (SYR) Contest and how organizations can participate. Find out how your tax site can successfully promote the SYR contest. Discover useful messaging to encourage clients to split their refunds. Also, hear how you can develop and promote your own contest. You will leave this training with tips to help your clients save even more money when the new tax season begins.

Presenters:

- Mariele McGlazer, Innovation Manager, Commonwealth – Boston, MA

- Cary Gladstone, Senior Director of Asset Building Strategies, Granite United Way – Manchester, NH

- Mindy Maupin, Credit Counselor, Southern Bancorp Community Partners – Little Rock, AR

Download the presentation slides and training notes.

Why Host a Taxathon NOW?

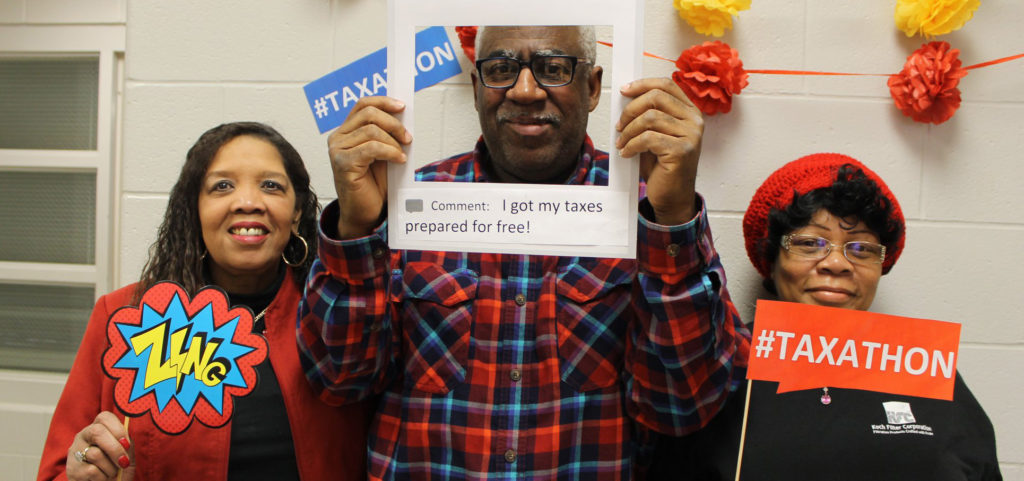

This next tax season promises new tax forms, tax law changes, and uncertainty. A Taxathon provides an opportunity to establish your tax site as a resource for the community during the confusion.

A taxathon is a tax filing event that can help you serve more clients, promote your tax site, and generate media coverage early in the tax season. Taxathons can establish enthusiasm and momentum at tax sites to carry you through the tax season.

Presenters share benefits of hosting a Taxathon and how to:

- Position your tax site as a trusted resource during tax reform

- Plan key Taxathon elements and manage site flow

- Organize Taxathons on a budget and with limited capacity

- Establish and enhance partnerships

- Message your Taxathon to staff, volunteers, partners, sponsors, media, and the community

Presenters:

- Andrea Kiepe, Prepare + Prosper – St. Paul, MN

- Brittany Sims, Louisville Asset Building Coalition – Louisville, KY

- Kelly Wagoner, The Piton Foundation – Denver, CO

Download the presentation slides and training guide.

Taxathon Resources

To help support your Taxathon planning efforts, our presenters have put together toolkits and other materials:

- Toolkit for Large Model Taxathons (Prepare and Prosper)

- Toolkit for Medium Model Taxathons (Piton Foundation)

- Toolkit for Small Model Taxathons (Louisville Asset Building Coalition)

- Printable Photobooth props

- Media Tips and Talking points

You can also download these Taxathon materials (Compressed/Zipped folder).

Effective Ways to Promote Split Refunds

Saving money shouldn’t be complicated. Tax time provides a unique opportunity to encourage clients to save more money by splitting their refund.

Join the Get It Back Campaign on Thursday, August 16 at 3:00 PM ET for a training on “Effective Ways to Promote Split Refunds.” Learn about the national Save Your Refund (SYR) Contest and how organizations can participate. Find out how your tax site can successfully promote the SYR contest. Discover useful messaging to encourage clients to split their refunds. Also, hear how you can develop and promote your own contest. You will leave this training with tips to help your clients save even more money when the new tax season begins.

Presenters:

- Mariele McGlazer, Innovation Manager, Commonwealth – Boston, MA

- Cary Gladstone, Senior Director of Asset Building Strategies, Granite United Way – Manchester, NH

- Mindy Maupin, Credit Counselor, Southern Bancorp Community Partners – Little Rock, AR

This training will be recorded. If you cannot join live, register anyway to get the recording and notes.

Recording: Embedding a Financial Coaching Model

During this one-hour training, The Financial Clinic’s team reviews the fundamentals of financial coaching, discuss strategies for incorporating coaching in your day to day work, and highlight how coaching can impact your program outcomes. They also explore several program models that deliver coaching in various capacities. You will leave this training with best practices and tools, coaching tips and tricks, and conversation starters so you can begin to coach (or strengthen your existing practice).

Presenters:

• Erica Davis, Partnership Associate, The Financial Clinic

• Megan Kursik, Assistant Director of Partnership Management, The Financial Clinic

Download the presentation slides and training notes. You can also access The Financial Clinic’s Toolbox on Change Machine.

Embedding a Financial Coaching Model

Join the Get It Back Campaign on Wednesday, July 25 at 3:00 PM ET for a training on “Embedding a Financial Coaching Model.” During this one-hour training, the Financial Clinic’s team will review the fundamentals of financial coaching, discuss strategies for incorporating coaching in your day to day work, and highlight how coaching can impact your program outcomes. We’ll also explore several program models that deliver coaching in various capacities. You will leave this training with best practices and tools, coaching tips and tricks, and conversation starters so you can begin to coach (or strengthen your existing practice).

Presenters:

• Erica Davis, Partnership Associate, The Financial Clinic

• Megan Kursik, Assistant Director of Partnership Management, The Financial Clinic

This training will be recorded. If you cannot join live, register anyway to get the recording and notes.

2018 Post-Tax Season Conference Call

Now that the hustle and bustle of the tax filing season has subsided, connect with your tax credit outreach colleagues across the country on Thursday, June 14, 2018 at 3:00 PM EDT (2 PM CDT/ 1 PM MDT/ 12 PM PDT) for a phone chat.

During this call we will discuss:

• Highlights and challenges from the tax season

• Changes in your tax site clientele

• Using drop-off VITA sites to expand reach

• Tax time and financial coaching

• Uber and Lyft tax clients

This call will be recorded. If you cannot join live, register anyway to get the recording and notes.

2018 Tax Season Kick-Off Call

Connect with your tax credit outreach colleagues across the country on Thursday, January 18 at 3:00 PM EDT (2 PM CDT/ 1 PM MDT/ 12 PM PDT) for a phone chat.

During this call we will:

- Chat about tax season kick-off plans

- Identify challenges from the past tax season

- Explore outreach strategies for the 2018 tax season

- Address any unanswered questions you have

This call will be recorded. If you cannot join live, register anyway to get the recording and notes.